Living with My AI Twin (I): The Meaning of Identity and Education in the Age of Personal AIs5/5/2024 On March 15, 2024, I introduced the world to my AI Twin — “Paul AI”. What exactly is the purpose of “Paul AI”? How do I interact with my digital counterpart, and how do others engage with it? Check out this post to discover more and learn how my life, the life of real Paul, has transformed since the birth of Paul AI. Hello, “Paul AI” Have you ever tried to imagine a world where you could have your own digital twin — your own digital counterpart that could interact, learn, and even teach on your behalf? I knew that world wasn’t far off, but I have never thought it could become possible so quickly. March 15, 2024 marks the day of “Paul AI” — it is my own digital twin that serves as a gateway for my friends, social media followers, my business partners and students to interact with my areas of expertise in a more discreet manner. How does “Paul AI” work? “Paul AI” is built on top my publications — dozens of law review articles, blog posts, and several books as well as my conference talks and webinars. This knowledge base resides in my personal data cloud and is knowledgeable about topics I have been exploring in nearly 15 years of my professional career such as copyright, intellectual property and international law, and more recently, data privacy and generative AI. What “Paul AI” actually does, it provides a way for anyone a way to interact with my specific areas of expertise — and search my knowledge based in a new way. Thanks to the advancement of AI and large language models, search has become a commodity. By having most of my publications and conference talks in one place, I can interact with such knowledge base by typing in any question, and get quite a solid response. You can try interacting with my digital AI twin — “Paul AI” — here and experience it yourself. What about security of data? Data security is one of the most paramount issues. In the case of “Paul AI,” we utilized publicly available information — thousands of pages of published law review articles, recorded conference talks, podcast interviews, and blog posts. Previously, one would have had to search online and read through this content to find an answer based on my area of expertise. However, in the age of AI, thanks to new data search capabilities, “Paul AI” offers the speed and previously unimaginable opportunities to interact with data in a new and dynamic way. Since the components of “Paul AI’s” knowledge base come from public sources, there is very little concern about data security: this information is already available on various platforms and databases. Moreover, as the creator of “Paul AI,” I have full control over what data sources constitute the knowledge base. I can add more sources if I find that necessary or remove some that are currently included. In addition to having full control over the knowledge base, I can also benefit from the dashboard to see what conversations are taking place with my AI Twin: what questions are people asking? How is Paul AI responding? However, I cannot see the identities of the people interacting with Paul AI. Paul AI: Today and Tomorrow As of today, the primary function of “Paul AI” is to provide a new way to interact with my specific knowledge base. This means you can search my knowledge base by typing in text and interacting with “Paul AI” via text. But what about using your voice? Can “Paul AI” respond in the real Paul’s voice? You might wonder. Indeed, numerous companies already offer solutions to clone your voice and likeness in a matter of seconds. At Prifina, we are tackling the more challenging task of allowing users to build a knowledge base from various data sources. These sources can include not only text, as in the current version of Paul AI, but also other types of data. Imagine incorporating heart rate data from your fitness tracker, or your medical records. Future versions of Paul AI will not only speak in my real voice but will also feature a virtual body avatar that reacts correspondingly. Furthermore, I could create additional twins — like “Paul Health AI,” which would hold not just my medical history but also recent biometric data, such as information about my activity and sleep patterns. Who might be interested in interacting with “Paul Health AI”? Potentially my family doctor, my basketball coach, my nurse, or even my life insurance company representative. The possibilities and opportunities for Personal AIs are immense: First Use Case: Teaching at Vilnius University Law Faculty with “Paul AI” I am particularly excited to deploy “Paul AI” as my AI assistant for the Data Privacy Law class I began teaching last week at Vilnius University Law Faculty. This year, I’ve decided to go “all in,” requiring students to utilize all available AI tools for class preparation and assignment completion. This includes #ChatGPT, #Claude, Meta’s AI, Inflection AI’s #Pi, Perplexity , and, of course, Paul AI. Each of these tools has its own pre-programmed limitations, and I aim for students to learn how to effectively collaborate with them. In my course, titled “Data Privacy Law: Human-Centric Approach,” “Paul AI” offers specialized knowledge on the subject. Over the past five years, I have extensively explored the human-centric approach to personal data — a topic that other popular AI assistants do not seem to cover as comprehensively. It has become clear, that “Paul AI” offers me an opportunity to curtail the duration of office hours, and reimagine the way how I organize the class, interact with the content and teach law-related subjects in such a rapidly evolving environment.

“AI is a gift to humanity that has been largely misunderstood.” — Prof. Mark Fenwick There are many ways AI can be applied in the classroom beyond just having students write essays using AI chatbots. While the internet has already broadened access to education, some may be wary of introducing AI into the classroom. However, it’s undeniable that artificial intelligence is set to transform education. The potential to further incorporate AI is substantial. It’s estimated that teachers spend 40% of their time on tasks such as grading and course planning. AI can assist with these essential but repetitive tasks, freeing up more time for professors to develop relationships with their students. AI can also enable students to learn faster and access a higher quality of education. While many consider this the future of education, it’s actually already happening right now! What do you think? We’d love to hear your views. In the future, we’ll continue sharing my experiences and exciting opportunities with personal AIs — stay tuned! Want to create your own AI twin? Sign up here — powered by Prifina — Liberty. Equality. Data.

0 Comments

By Dr. Paul Jurcys (Co-Founder, Prifina) Happy Valentine's Day! On this day when the world celebrates love and connection, I would like to share a few thoughts about a rather new paradigm - our relationships with Personal AI assistants and “AI buddies” that are gradually becoming our daily digital companions at work as well as our private lives. I have no doubt that you have been increasingly relying on AI tools such as ChatGPT, or myriads of other AI assistants that helps solve various tasks, I wonder:

Generalists vs. Personal AI Assistants

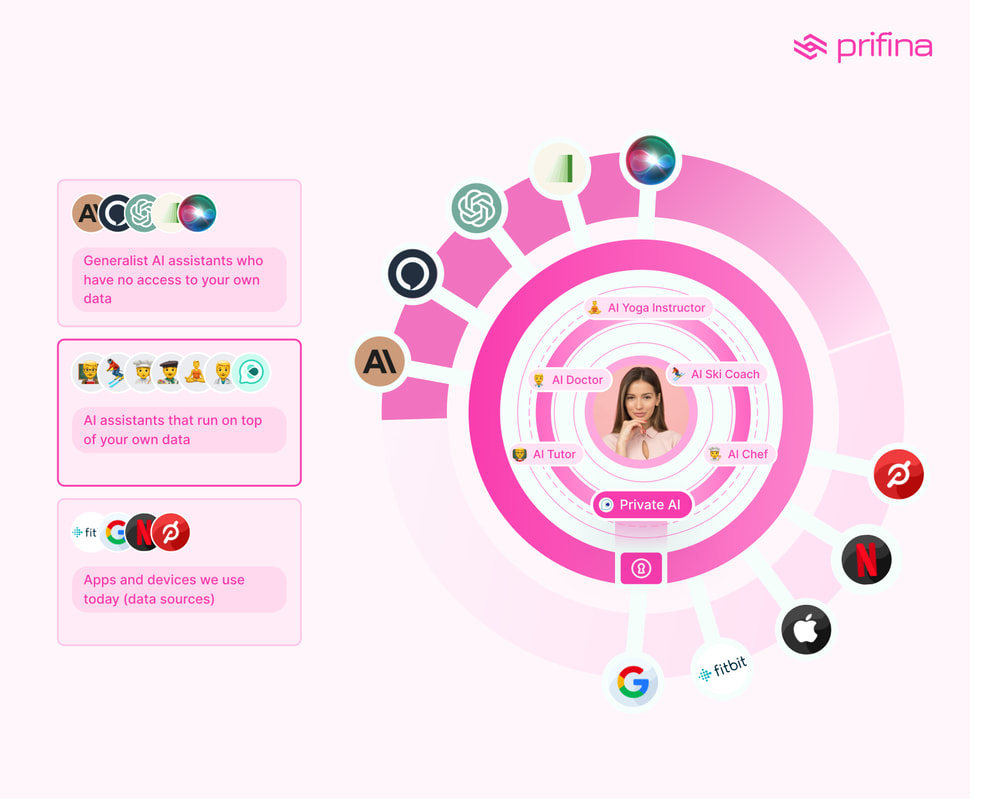

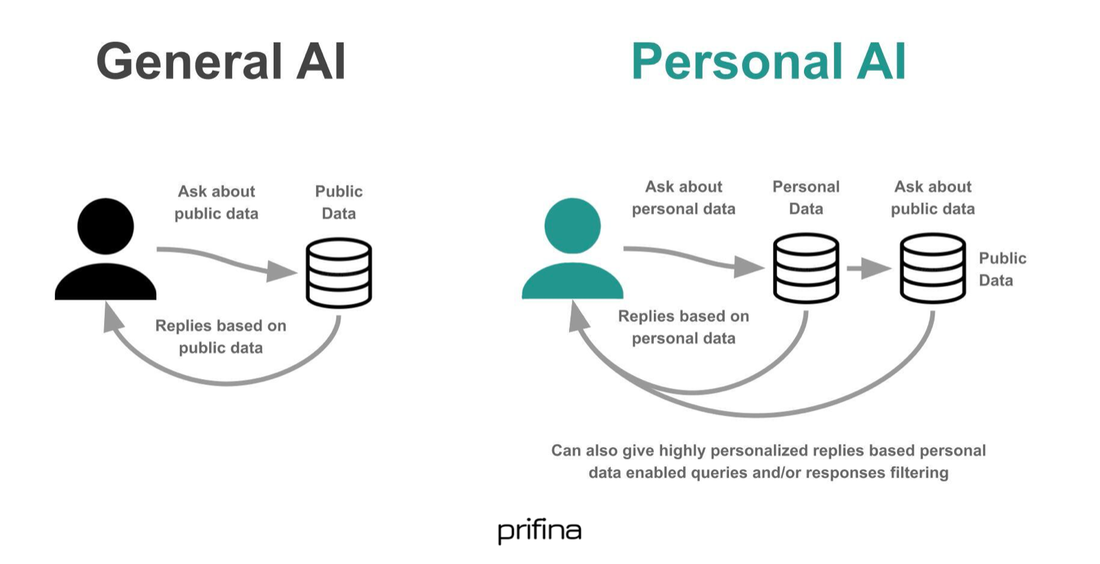

The emergence of Siri, Alexa, and ChatGPT reveals a fascinating landscape of technological advancements tailored to our personal, professional, and intimate lives. At the outset, I believe we should distinguish between “generalist AI assistants” and “Personal AI buddies.” Generalist AI assistants, such as ChatGPT and Alexa, designed to provide a broad range of services without accessing personal data. They excel in offering information, performing tasks like setting alarms, answering general queries, and controlling smart home devices through voice commands. Their strength lies in their versatility and the ability to serve multiple users without customization. On the other end of the spectrum, personal AI assistants take customization to the next level. Such assistant are able to tap into a wealth of your own personal data (e.g., data from wearables like Apple Watch or Oura Ring, your own Google Maps starredlocations, and payment histories from your personal credit card records) to offer highly personalized advice, reminders, and insights. These Personal AI buddies can be playful or very practical. Think of a My Fashion AI advisor that knows the styles I like, the shoes I have, as well as the colors I hate to wear. I can talk to my fashion AI advisor about the outfit I should wear for tonights date with my Valentine. In the wake of shortage of human experts (yes, we will never have enough doctors, coaches, or emotional support friends!), specialized AI assistants are becoming increasingly meaningful. Think of an Personal AI doctor who has access to my hearth rate data and sleep information from my wearables, and is capable to monitor different health metrics, suggest activities based on location and preferences, and predict certain events based on my own biometric data. It is not hard to imagine a personal AI finance advisor that knows my spending patterns and history, and can help manage my finances by tracking spending patterns, and nudging to save more wisely to achieve certain financial goals. Assistants According to Functions Performed Simple Personal Avatars help users represent themselves in virtual environments, such as video conferences or virtual reality platforms. They are designed to mimic the users appearance and mannerisms but do not necessarily require deep personal data access. Digital Twins is a step further in terms of their complexity. Digital twins utilize extensive data to simulate and predict outcomes in various scenarios. For instance, a digital twin could use health data from wearables to forecast potential health issues, enabling preventative care. Conversational Interfaces: AI assistants with conversational interfaces, such as ChatGPT, serve a wide array of problem-solving purposes. They can range from general assistants answering any query to specialized ones like AI nutritionists offering certain healthy diet advice or "intimate buddies" providing emotional support. These AI assistants rely on natural language processing to understand and respond to user inputs meaningfully. AI Agents Performing Tasks: These AI assistants are capable of executing specific tasks on behalf of the user, such as purchasing concert tickets or booking appointments. They might access personal calendars, preferences, and financial information to autonomously carry out tasks, streamlining the user's daily routine and ensuring engagements align with their interests and schedules. The Privacy Paradox in the Age of AI Creating personal AI assistants that genuinely understand and cater to our unique preferences and needs, requires a nuanced approach to data utilization and privacy. Let’s take a very practical illustration: what does it take to build a truly personal travel AI advisor? What specific user-generated data would be needed to build a truly personal travel AI? The answer largely revolves around integrating user’s own data from various sources that could help inform the AI to make truly personalized travel recommendations: Accessing Calendar Data: your personal AI travel advisor could benefit by integrating with your calendar data. This connection could offer insights into your available free time, potential holiday slots, and preferred travel durations. By understanding when you are planning to take time off, the personal travel AI advisor can suggest travel options that align perfectly with your schedule. Leveraging Google Maps Data: Further personalization could be achieved by analyzing your Google Maps data. This could include places you have frequently visited and enjoyed, restaurants that align with your culinary preferences, and even destinations you have marked as "want to visit." Such data could enable the personal AI travel assistant to craft travel suggestions that resonate with your past experiences and future aspirations, making every recommendation feel tailor-made. Incorporating Airbnb Booking History: Additionally, integrating our Airbnb booking history could provide the AI with a deeper understanding of your accommodation preferences and budgetary constraints. By analyzing the types of places you have stayed in the past, the personal AI travel advisor can tailor its accommodation suggestions to match your taste and financial comfort zone, further personalizing the travel planning process. However, the aspiration for such a highly personalized AI travel advisor encounters significant hurdles under current data privacy regulations and the reality of data silos maintained by tech giants. These barriers often prevent the seamless integration and utilization of data across platforms, limiting the potential for truly personalized AI assistants. To overcome these challenges, a radical reimagining of the data ecosystem is necessary, where individuals have sovereignty over their data. In this envisioned future, personal AI assistants operate directly on user’s own data, where data is private-by-default, ensuring personalization does not come at the expense of data privacy. This shift towards this more human-centric and user-controlled data ecosystem not only promises to enhance the personalization of AI services but also represents a critical step towards reconciling the competing interests of data utility and privacy. By placing individuals at the center, we can unlock the full potential of AI in personalizing experiences while safeguarding our right to privacy. Reimagining Consumer Experience in the Age of Personal AI’sIt’s time to recognize that we are rapidly entering an era dominated by personal AI assistants who will be seamlessly integrated into many aspects of our daily lives, including our most intimate spheres. It is also obvious that the way how we interact with apps and digital services is set to undergo profound transformation. Rather than having hundreds of apps, we will have one single portal with personal AI agents that have different specializations, and know us deeply (based on our own data). This transformation beckons us to ponder deeply about the nature of our future interactions with intelligent AI assistants and agents and the implications of such relationships on our emotional well-being and the essence of human connections. How Do We Build Trust with AI Companions? The foundation of any meaningful relationship, whether with humans or AI, hinges on trust. Therefore, understanding and building trust with these synthetic agents becomes paramount. Trust in such Personal AI assistants will not solely be about reliability or accuracy but will also encompass ethical considerations such as privacy, data security, and the AI's decision-making processes. How do we ensure these AI companions act in our best interests, and what mechanisms will be in place to safeguard our autonomy and privacy? Transforming Interactions and the Future of Intimacy The proliferation of AI agents will redefine our interaction with the world and each other. These AI companions could become our confidants, advisors, and caretakers, managing not just our schedules and health but also providing emotional support. The depth of these interactions raises questions about the nature of companionship and the role of AI in fulfilling human needs for connection and empathy. Will these sophisticated AI agents be able to discern and adapt to our emotional states, offering comfort and advice akin to a human friend or therapist? Relying on AI for emotional support and companionship introduces a paradigm shift in the understanding of intimacy. As personal AI assistants become more integrated into our lives, it's crucial to consider how this will shape our perceptions of love, friendship, and emotional support. Will AI companions complement human relationships, offering support where human availability is limited, or might they supplant traditional human connections in some aspects? Implications for Human Connection and Love The advent of emotionally intelligent AI raises profound questions about the future of human connection and love. As we form bonds with AI entities capable of understanding and responding to our emotional needs, it's imperative to reflect on how these relationships will coexist with human-to-human connections. Will the convenience and consistency of AI support erode the value we place on human imperfections and the unpredictable nature of human relationships? Or, conversely, could the presence of AI companions prompt a deeper appreciation for the unique aspects of human connection that AI cannot replicate? The journey into a future with personal AI asisstants invites us to embrace the possibilities and opportunities of improving our daily lives. The vision of such AI-powered future also requires us to critically assess and navigate the challenges that lie ahead. Let us embrace this new reality and work together in shaping the future. In December 2024, SITRA, the Finnish Innovation Fund, honored Prifina as one of the most innovative consumer data companies. We are thrilled to receive this recognition and remain dedicated to reshaping the personal data economy for the better. Below is the English translation of a special article about Prifina which appeared on SITRA's webpage on December 11, 2023. Prifina returns consumer data from major corporations back into people's control. Prifina has built a solution where individuals manage their personal health and fitness data, for example, through their own data clouds. At the same time, it offers opportunities for all companies to build applications where they don't have to manage user data but instead access users' personal data clouds. Prifina's goal is nothing less than a revolution in personal data management. For instance, when a person goes for a run wearing a heart rate monitor, producing personal data, currently, that workout information typically remains in the ownership of the software company providing the health app. In Prifina's vision, the data doesn't remain with the app provider but is stored in the user's personal data cloud. So, the running app only comes to work and, once the workout is done, it leaves the measurement results to the customer. Prifina offers a place for this data as a service. "The architectures, features, and pricing of major cloud services have evolved so much that it is possible to build infrastructure where people retain and manage their data. Applications simply use the data stored in people's personal data clouds," says Valto Loikkanen, Co-founder and Platform and Usability Architect at Prifina. Prifina: Back to the Future"Before, applications primarily ran on our computers, and we managed the associated data ourselves. Then the data moved to user accounts on the internet. An assumption arose that software companies owned user account data and used it in their business as they pleased." Things can be different, and many would benefit from it. According to Loikkanen, many companies would gladly relinquish data management during tightening data protection regulations and data breaches, focusing on their core business. Many people are also concerned that their personal health or driving data ends up with international data giants. The opportunity to control it is appealing. Real-time and comprehensive insights into one's well-being"We want consumers to derive value from their data primarily for themselves. Only after that comes data-driven business," says V. Loikkanen from Prifina. Value can be generated in many different ways. Health and fitness data collected, for example, through location information and sensors can offer a comprehensive view of a person's activities, such as their well-being. Other types of data and use cases from various life areas, such as an automatic diary, can also be integrated into the solution, as discussed below. Prifina's AI connected to the data cloud can provide recommendations based on the data to improve well-being or achieve fitness goals, for example. The more Prifina knows about its owner, the more detailed recommendations the user receives. Prifina encourages third-party developers to create new services using individuals' data that operate privately within users' data clouds. If they wish, data cloud owners can share their data for free or for a fee outside their own data cloud for the use of companies or researchers if it makes sense to them. The data ownership revolution begins in 2024If in the future, apps visit the data, app marketplaces will also change. In Prifina's app store, consumers can buy apps built on their personal data. Consumers pay Prifina for the use of their own data cloud and for the apps to their developers, as they do today. Of course, there are also free apps available. The app provider, in turn, pays Prifina a commission for using the marketplace. "There are so many opportunities associated with personal data ownership and utilization in software development that we cannot and do not want to come up with all of them ourselves. That's why it is essential that anyone can build and publish various services on top of Prifina's data clouds," says V. Loikkanen. So when will the data ownership revolution become visible and audible to consumers? According to Loikkanen, Prifina has been prepared determinedly but without haste. At the turn of the year, Prifina will launch a diary app that automatically writes diary entries based on phone location data, pictures, and the calendar, which the owner can then enrich. In the initial stage, the diary app's data will remain on the phone, but gradually Prifina will start offering data cloud as a location for the data. The goal is that people understand the benefits of the service and become interested in other apps developed around the idea of data ownership. So, the diary app is the first directly consumer-focused step in Prifina's revolution. In other respects, Prifina has been developed in cooperation with various app developers and companies for a long time. The plan is to launch the service as a whole when there are more apps available that illustrate the use of personal data between different apps. Prifina aims for a data ownership revolutionPrifina, soon to be launched on the market, is a solution that offers consumers data clouds. With these, they can manage their personal data. Prifina enables individuals to combine various data sources, such as health and fitness data, to gain a more comprehensive picture of their well-being.

Additionally, Prifina offers a marketplace for software companies where they can sell applications that do not store people's data on company servers but use individuals' own data clouds in their operations. Consumers can purchase these apps for their use. What they're saying about Prifina's solution "We want to offer our users a unique user experience where our skiing products, such as boots, have sensors that, based on their data, allow us to provide, for example, digital skiing instruction and improve safety on the slopes. Through collaboration with Prifina, we avoid significant investments and costs related to data management. With Prifina's help, we can demonstrate that we respect our customers' privacy." -Hans-Martin Heierling, Founder, Swiss skiing brand Heierling" By James Donck, Prifina In today's rapidly evolving technology landscape, the great outdoors isn't left behind. It's fascinating how tiny, cost-effective sensors are revolutionizing outdoor gear – from backpacks and hiking boots to tents and sleeping bags. These innovations are enhancing safety, comfort, and connectivity for outdoor enthusiasts, ushering in a new era of smart adventuring. Let’s explore some of the ways sensors are augmenting outdoor gear and the opportunities this presents for outdoor brands to deliver more value to their customers. Smart Backpacks: A Game Changer in Load Management Weight distribution is crucial for comfort when carrying a backpack over long distances. By embedding load cells and pressure sensors at multiple points along the shoulder straps and back panel, backpacks can now detect weight and shifts in load. The data can provide hikers with real-time feedback when packing their bags and adjustments needed on the trail. Brands like Osprey Backpacks integrate such technologies in high-end backpacks to analyze how the bag carries weight; as a result, such new technologies can help prevent back or shoulder strain. There’s potential to connect load data with GPS coordinates to correlate terrain changes with weight shifts. By linking load data to a mobile app, backpackers can receive tailored advice for rest stops or repacking based on their personal profiles. Next-Gen Hiking Boots: Your Personal Trail Analyst Injury prevention is critical for serious hikers and thru-hikers. Sensors integrated into hiking boots and insoles can unobtrusively perform gait analysis to detect imbalances or irregular walking patterns. A variety of sensors, such as pressure sensors, accelerometers, and gyroscopes, enable products from companies like Digitsole and Underfoot Athletics to provide insights into aspects like weight distribution across the feet, the impact of varied terrains, the development of micro-fractures, and overall fatigue levels during a hike. When sensor data is made actionable through mobile alerts and post-hike analysis, it allows hikers to optimize insoles, adjust techniques, take timely breaks, and aid recovery. This helps prevent painful, activity-limiting injuries in the wilderness. Brands that tap into sensor-enabled hiking shoes and boots have the opportunity to build customer trust and loyalty. The Rise of Smart Tents: More Than Just Shelter Pitching tents in unpredictable outdoor conditions presents challenges regarding comfort and safety. Environmental sensors, such as occupancy, motion, light, pressure, and temperature sensors, embedded in tents can help address many of these issues. Occupancy sensors enable automatic adjustments to lighting, heating, ventilation, etc., based on tent usage patterns. Passive infrared (PIR) motion sensors serve as security systems, sending alerts when unexpected motion is detected around the tents. Smart Wool, an outdoor apparel brand, already offers a smart tent equipped with occupancy, temperature, and light sensors. These sensors allow for the automatic opening and closing of windows, turning interior lighting on or off, and even automatically starting a morning coffee maker! Location-tracking sensors in tents are also highly valuable, assisting campers in finding their way back after a day's adventures. As consumer IoT continues to gain traction, purpose-built shelters are increasingly becoming equipped to keep outdoor enthusiasts secure and comfortable. Personalization: The Frontier of Outdoor Gear Sensors integrated into backpacks, footwear, and shelters provide invaluable usage data, and combining this with biometric inputs measured via smartwatches or fitness trackers offers more personalized experiences. Here are some compelling use cases: Optimizing Gear Settings with Health Correlations Rather than relying on generic occupancy thresholds for HVAC adjustments in smart tents, your body temperature, captured by your fitness band, can trigger highly customized heating or cooling tailored to your specific needs and comfort levels. Analyzing gait abnormalities from hiking boot sensors, along with stress and fatigue levels from your watch, can determine whether terrain changes or physiological exhaustion are causing these anomalies. This enables selective course corrections. Implementing such closed-loop systems requires ecosystem integration, but the value generated for users is immense. Location History Enhances Safety Features Your smart backpack, knowing that taking the northern trail in Yosemite previously elevated your heart rate due to stress, now can use this data, synced from your Apple Watch, for real-time guidance. It can automatically suggest less intense routes and rest stops by cross-referencing sensor data with your physiological history and biome profiles. Similarly, a history of respiratory issues or heart conditions can provide context for any irregularities in vitals detected via wearables while on remote trails. This could automatically activate emergency contacts or guide first responders more quickly, potentially saving lives. Fueling Discovery with User-Specific Insights

Analyzing multi-parameter data history across gear sensors and wearables enables ultra-personalized recommendations for outdoor activities suited to your biomechanical and physiological traits. Platforms like OutdoorVoices already provide assessments that match user profiles with ideal outdoor activities. In the future, expect detailed sensor data streams to offer inputs for highly customized assessments on a larger scale. Privacy and Consent: The Backbone of Smart Gear While the depth of insights unlockable via sensor and wearables fusion is undoubtedly powerful, users must trust brands with personal data access. Consent flows and privacy-preserving data handling is thus mandatory before orchestrating multiple data streams seamlessly. Looking Ahead: The Boundless Potential of Sensor-Integrated Gear The future looks bright for sensor technology in outdoor gear. Humidity sensors in backpacks could prevent mold, while smart sleeping bags might adjust insulation based on the occupant's needs. As these technologies become more affordable, brands have a unique opportunity to create extraordinary experiences for their customers, deepening connections and distinguishing themselves in a competitive market. In a world where smartphones have replaced maps, cameras, and flashlights, it’s not a stretch to envision a future where outdoor gear is equally smart. The question for brands now is whether to lead this revolution or play catch-up. The future of outdoor adventuring is smart – and it's already here. On October 30, 2023, Prifina's Co-Founders, Jouko Ahvenainen and Paul Jurcys, together with partner experts, submitted Prifina's response to the U.S. Copyright Office's request for public comments on "AI & Copyright." You can find the full report here.

On September 19-21, 2023, the Prifina team attended the largest frontier tech event of the year in the Bay Area - TechCrunch Disrupt 2023. We had an opportunity to meet new and current partners and showcase some of the use-cases where Prifina’s partners are leveraging Prifina’s personal data platform to offer services on top of users’ own data. In the post below, we summarize some of our main accomplishments during TechCrunch 2023, and also provide some insights about the current trends in the consumer data and AI market. Prifina's Hub at TechCrunch Expo Hall This year at TechCrunch Disrupt, the Prifina had a booth located in the very center of the expo hall thus becoming a hub of attraction for people who came to see what are the latest developments in frontier tech. At our booth the Prifina team primarily aimed to focus on two areas of our work:

Showcase of sensorized products At Prifina's stand, visitors could see and experience how sensors are added to the physical products we use daily. Specifically, the Prifina team brought real sensorized helmets and headbands produced by our partners Haierling (making sensorized ski boots) and Samphire Neuroscience (producing menstrual neuromodulation devices). Those devices helped us illustrate how Prifina empowers individuals to collect data from various sensors and platforms and build compelling solutions on top of consolidated users' data. In the case of a ski coach, for example, the user not only gets a report about the ski performance but can also talk to a personal AI ski coach about the recovery after an intense ski experience. Such recovery is possible because the user can collect data from various data sources (e.g., ski boot sensor and a sleep tracking device such as Apple Watch or Oura Ring). Showcase of Personal AI Applications As we enter a world where every service we use is transforming into AI-powered assistants, one question remains: how do we make AI assistants really personal to the user? With Prifina's human-centric data infrastructure, it is rather simple to build AI-powered assistants: we need to build the assistant to the user, and tap into the combined of the user. Here is how it looks in practice: assume you want to build a "Personal AI travel agent" app. What data would such an AI assistant need to make recommendations that are truly personal to me? In this case, perhaps it is about: (i) my previous bookings on AirBnb platform, (ii) my starred locations on Google Maps (places I liked and places I marked as to be visited in the future); (iii) obviously, my calendar(s) so that I could plan accordingly, and (iv) perhaps my payments history. In Prifina's architecture, the user downloads the "Travel AI Assistant App" and runs on top of his/her own data, which includes various data sources, also possible is the four mentioned above. Such Travel AI Assistant app runs privately (on top of device, or in my own personal data hub which only I can access). Prifina's human-centric data architecture received much attention; we are onboarding new partners to build applications that run privately on the combined data set that users have in their personal data environments. General Takeaways and Market Trends After spending three days and talking to hundreds of founders, partners and investors, we have the following three takeaways about the market trends: 1. AI everywhere, even where it is not needed There is so much buzz about Artificial Intelligence. There is no question that AI tools and AI solutions are coming to many areas of our work, social life and leisure. AI tools will help curtail the amount of redundant tasks and help people focus on things that matter more, increase efficiency. In fact, this process of AI tools has been already taking place for quite some time, but the emergence of OpenAI's tools such as ChatGPT has made it really obvious. We also observed that the AI hype could get out of control: namely, we see how startup founders and builders are trying to add "AI" even to those areas where it does not make any sense. The result? Clumsy and complex UX, forced functionalities that are not needed. We understand that is a natural process of trial-and-error; we just hope that it will not take too much time and resources. 2. Sensors and Empowerment with Raw Data Similarly to other technology conferences in 2023, we see witnessed the wave of sensors rapidly entering every aspect of your physical lives. From sensorized running shoes, sensitized toilet seats, complex sensorized exoskeletons to sensorized workspaces, sensors and transforming how we live, work and recover. 3. Predictive Analytics for Consumers At TechCrunch we evidenced many fertility, sexual, reproductive, and other solutions that rely on sensor data and provide insights and nudges for consumers. Some of those solutions are diagnostic and clinical focusing on sophisticated biometric data, others are simple consumer-facing apps. Yes, one of the key common thread among sensors and AI-powered apps that offer predictive analytics is the need to adopt a more holistic approach to data. That's where Prifina's human-centric data model for user generated data has received most attention and validation. We are looking forward to continue our work with Prifina's current and new partners to unlock the value from users' data created across platforms and devices. Showcase of sensorized products At Prifina's stand, visitors could see and experience how sensors are added to the physical products we use daily. Specifically, the Prifina team brought real sensorized helmets and headbands produced by our partners Haierling (making sensorized ski boots) and Samphire Neuroscience (producing menstrual neuromodulation devices). Those devices helped us illustrate how Prifina empowers individuals to collect data from various sensors and platforms and build compelling solutions on top of consolidated users' data. In the case of a ski coach, for example, the user not only gets a report about the ski performance but can also talk to a personal AI ski coach about the recovery after an intense ski experience. Such recovery is possible because the user can collect data from various data sources (e.g., ski boot sensor and a sleep tracking device such as Apple Watch or Oura Ring). Showcase of Personal AI Applications As we enter the world where every service we use is transforming into AI-powered assistants, one question remains: how do we make AI assistants really personal to the user? With Prifina's human-centric data infrastructure, it is rather simple to build AI-powered assistants: we need to build the assistant to the user, and tap into the combined of the user. Here is how it looks in practice: assume you want to build a "Personal AI travel agent" app. What data would such an AI assistant need to make recommendations that are truly personal to me? In this case, perhaps it is about: (i) my previous bookings on AirBnb platform, (ii) my starred locations on Google Maps (places I liked and places I marked as to be visited in the future); (iii) obviously, my calendar(s) so that I could plan accordingly, and (iv) perhaps my payments history. In Prifina's architecture, the user downloads the "Travel AI Assistant App" and runs on top of his/her own data, which includes various data sources, also possible is the four mentioned above. Such Travel AI Assistant app runs privately (on top of device, or in my own personal data hub which only I can access). Prifina's human-centric data architecture received much attention; we are onboarding new partners to build applications that run privately on the combined data set that users have in their personal data environments. Event Recap: "Revolutionizing Risk: How sensors, Ambient Data and AI Are Reshaping the Insurance"9/9/2023 On September 5th, 2023, Prifina hosted a panel discusion "Revolutionizing Risk: How Sensors, Ambient Data and AI Are Reshaping the Insurance." Among the panelists were:

The panel discussion explored the current trends in the world where sensor-generated data and AI-powered applications permeate every aspect of our lives. Could such data be used to personalize insurance services and unlock new solutions to help us reconsider how we approach risk? The event on the implications of sensors and data on insurance gathered much attention from various representatives of different industries. In the following post, we review some of the discussion topics and provide a list of innovative solutions for insurance services. 1. Paramount role of data for insurance The starting premise of this event was the realization of the huge amount of data generated by users themselves (e.g., data from sensor-equipped fitness trackers) and ambient data from sensors in office buildings and public spaces. Yet, appr. 80% of such data lies idle, unutilized. Markus Lampinen from Prifina opened the panel discussion by explaining the paradigm shift that is happening in the personal data market - a new data framework the value from data is captured on the users' side (not locked away in centralized silos): “In the future, we want to see individuals getting the value from data captured across different data sources. We want to empower individuals with different types of applications that you own and that you run on top of your own combined data. Very simple things that help you sleep better or buy the right shoes, etc. But we already have those. The big picture? In 5 years, as an individual, I’d like to be able to predict what movie I’d like to see, and what better choices I should make.” Ashley Greenwald from Huntsman AG explained the concept of "ambient data" - data from sensors embedded in spaces around us (temperature, noise, occupancy, vibrations, exposure light, humidity) - all of this data could be used to improve the efficiency of space management and human experiences. Such data from sensors in buildings is particularly interesting for building owners and renters. 2. Tight Regulations Limiting the Use of Personal Data Signe from Datasolvr and Markus discussed the fact that data privacy regulations and well as risk-awareness of service providers limit the use of individual-level data for personalization. Companies don't want to face data discrimination lawsuits and opt not to use data in their services at all. While the individual-level data could be particularly interesting for creating different pricing models, data privacy regulations are tight both in Europe and in the US. 3. Building Predictive Health Care System with Data Participants of the panel discussed the ways how user-generated and ambient data could be used to enable predictive health and wellness services. This would be a major juxtaposition to the current "reactive" medicine which is extremely costly. "In reality, when you go the hospital, you realize that many health-related data could have been avoided if various data sets were caught and utilized earlier." - Markus Lampinen Another truth of the fact is that we are running short of doctors, physicians and experts: there are appr. 10 million doctors in the world for a population of 8 billion people. And we will never have enough doctors. At the same time, people are increasingly eager to extend their well-being and the quality of life. That's where sensor-generated data and data-powered AI applications become increasingly appealing: "Harnessing data from devices like the Apple Watch could help increase individual awareness of stress and potentially prevent harmful effects using predictive AI. That's one of the biggest opportunity for insurance service providers who ultimately want to mitigate risks." - Sille Amid Holm (Datasolvr) Individual-level use cases. The panelists explored several examples of utilizing user-generated data from wearables in insurance. For instance, renewing term life insurance is complex, with current pricing influenced largely by an individual's health condition, such as whether they smoke. For instance, smokers typically pay at least twice the premium compared to non-smokers of the same health. However, the potential use of comprehensive data collected over years could reshape this model. If data shows an individual quit smoking and improved their health over a decade, they might deserve a reduced premium, even if they're older. This concept suggests a more dynamic and responsive insurance model, though the decision rests with insurance companies. Group-level use-cases. Group-level data from wearables as well as ambient data could be a powerful tool to innovate in the insurance services market. Imagine, if an employer could prove certain habits of the employees (e.g., employees chose to walk up the stairs and sleep on average 6.5 hours a night) to the insurance company, this could offer additional insights and price adjustments for various insurance plans. 4. Creating New Consumer Experiences with Data The panelists discussed various opportunities and challenges when it comes to building new consumer experiences with data. Many consumers need super simple interfaces and huge incentives; there is also a huge learning curve ("data literacy"). A huge part of this relates to the experts working in the User experience/user interface domain: How do you show the value from data to the individual? How to help people to better understand what to look for in their data? There're many interesting insights about how people have adopted wearable devices: e.g., we see how much more aware about their biometric data people have become. However, it is quite difficult to build data-driven experiences in the insurance services market. The customer onboarding and customer journey has to be very different in insurance. Since more people interested in insurance services tend to be senior, the experience must be simple and understand. Here are some examples of gimmicks that could be used:

Accelerating innovation. The flip side argument of that is whether big players in the insurance market would like to innovate, or whether they'd rather prefer the status quo. Markus Lampinen from Prifina suggested that such a hold-out strategy by incumbents may not last too long especially when more innovative newcomers in the insurance market come up with more personalized and compelling products. 5. Personal AI agents powering a new line of insurance services The panelists shared their common understanding that in the near future each of us will have our personal AI assistant experts (doctors, coaches, nutritionists, shopping agents). This world becomes possible as individuals get more ownership and control over their own data. More generally, panelists agreed that user-generated and ambient opens new opportunities for virtually every stakeholder in the market, including innovation opportunities for insurance services that will become very personalized and specific. Future vision. Imagine if your personal AI insurance agent negotiates on your behalf with AI-powered agents of insurance providers to find the best deal for your specific condition. The panelists even explored possible implications if an individual's own AI agent was aware of individual's DNA data and historical medical records and how this degree of data accuracy and automatization could transform the whole understanding of risk. We want to thank all the panelists and guests who attended the event and stayed after the panel to network and continue the conversation about the emerging personal data ecosystem. “Whoever wins the personal agent, that’s [going to be] the big thing. Because you will never go to a search site again, you’ll never go to Amazon again” - Bill Gates By dr. Paul Jurcys In the very near future, each of us will our personal AI assistants for every aspect of our lives. Each of us will have our personal AI doctor, personal AI coach, personal AI nutritionist, or digital assistant that will help us organize our calendars, schedule events, and purchase items on our behalf. Such AI-powered assistants will augment our abilities and help get rid of time-consuming tasks, and focus on things that matter most.

Buzz In the Market In the past few months, there has been quite a bit of excitement about the possibility of building truly personal AI:

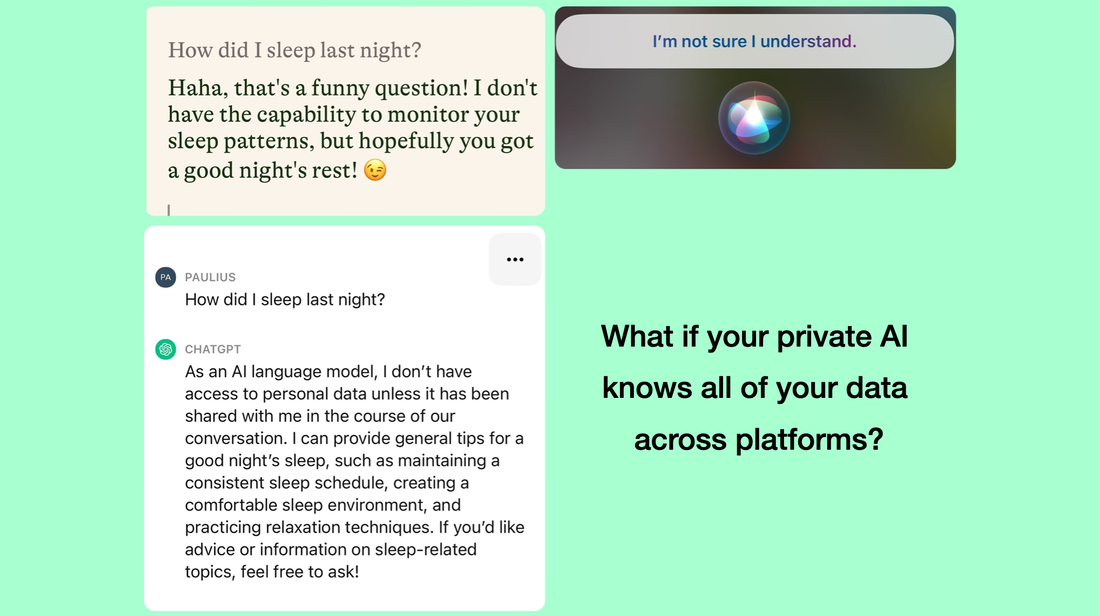

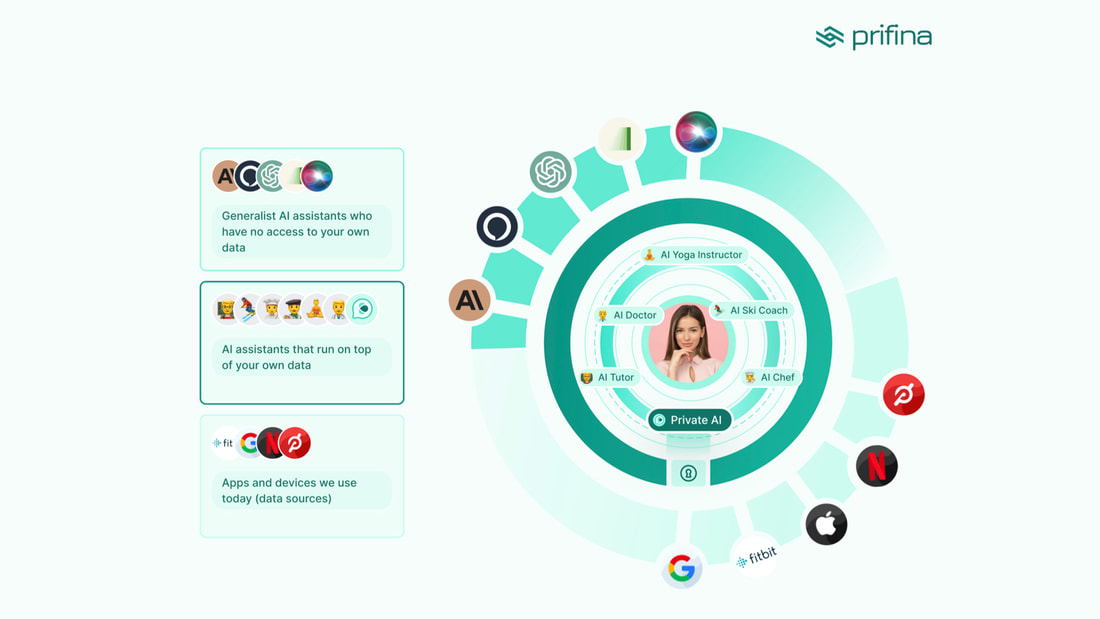

A massive investment in InflectionAI could be seen as an attempt to stave off any potential competition and secure dominance in this rapidly emerging domain. Shortage of Experts Today, we are unfortunately facing a remarkable shortage of experts. With over 8 billion people on Earth, there are a mere 10 million doctors. Teachers struggle to spend enough time on direct interactions with every student in the class. On a personal level, we often lack someone equally knowledgeable or passionate about our favorite topics. In times of grief, suffering, and emotional pain, the desire for a close companion to provide advice and understanding becomes ever more acute. This is where the transformative power of AI comes in. In the near future, countless individuals, potentially everyone, will be able to augment their personal capabilities with our own personal AI assistants. The trajectory toward universal access to intelligence is clearly mapped out: we can expect that any person with access to the internet and a hand-held device will have access to the same expert advice from a doctor, an educator, or any other specialist, all through their personal AI. 2 Ways to Build Personal AI As technology continues to leap forward at ever-increasing speed, personal AI assistants are evolving to become more sophisticated and versatile. There are two paths of bringing AI superpowers to humans: A top-down approach: after the release of ChatGPT and other generative AI tools, we are witnessing an influx of various personal AI assistants that are supposed to hello us find information, summarize text, or generate images. The top-down approach is rooted in creating software applications - personal AI assistants - that are marketed as tools to help us solve various daily tasks and assignments or offer us a companion, a buddy that is available 24/7. Think of InflectionAI’s Pi, Midjourney, Dalle, and countless others. However, most of our essential tasks are rooted in the physical world: we need to eat, sleep, and and go to the bathroom. As cheap sensors are being integrated in our wearable devices and environments around us, individuals have tools and ability to track personal biological clock - we start living quantified lives. If you are a runner, you probably have a fitness tracker to measure your running distance and heart rate, as well as recovery rate. Also, our cars track hundreds of data points (e.g., acceleration, braking, engine performance, and outside factors). Scientists around the world are building assistive robots to help us to recover from injuries or learn important skills. These sensor-derived data sets also lead to the development of AI-powered applications that help optimize different aspects of our lives. This sensor-data-AI path resembles a bottom-up approach to building personal AI. Data Eats the World, But How to Access Data? AI assistants such as ChatGPT, or PI, are amazing in answering our general questions and performing general tasks. However, if you ask anything personal, something related to yourself, they stumble. Let’s see what responses we get to the question “How did I sleep last night?”: How come!? Isn’t it odd that if you wear Apple watches that track our activity, sleep and process various biometric data, Siri - an AI assistant built by Apple for Apple’s products - is not able to answer such a simple question?! Eventually, every company building personal AI will face the challenge of connecting the personal AI to the user’s own data. To build a truly personal AI, we need not only general knowledge from publicly available sources and research repositories, we also need to bring this general, publicly available knowledge and correlate it with the specific data of each individual. In other words, to build a truly personal AI, Ai assistant must be able to access to the user’s personal data. Otherwise, the AI assistant will be a generalist, not a personal: This is where Prifina’s human-centric approach to data comes into play: with Prifina’s user-held data model, it is possible to bring those personal AI assistants to each individual and run those personal AI assistants “on top of” each user’s own data, privately. In Prifina’s personal data ecosystem, each individual user connects their data from personal data sources to their own data “vault”, where data is collected and unified. AI-powered apps and assistants run in each individual users’ data environment. Each individual user’s data is private by default. A human-centric approach to data opens vast opportunities for the use of personal data: not only personal AI assistants can answer the question about last night’s sleep, but ML and LLMs can offer new possibilities for personalization and automation of tasks and generate new value for individuals. Multi-Agent Interface So how many personal AI assistants can there be? And how many AI assistants can one person handle? As humans, we have limited time and a limited attention span. Our guess is that each of us will be really interacting with 5, 7 or 10 digital agents (similar to a manager at a corporation who has 7-10 directly responding employees). The image below illustrates the universe of digital assistants in the human-centric environment:

These digital agents will also vary in their expertise, capabilities, and proximity to the individual human being. It is likely, that people will have their own AI doctors, AI coaches, and AI-powered shopping assistants who will help to achieve specialized tasks.

Some of them will operate in the “inner orbit” - on top of the user’s own data, privately, while other AI assistants will be generalists, and will not have access to user’s own data. In this multi-agent environment, one possible scenario is that each individual will have one primary and preferred assistant - we can call it “my personal AI.” But how will those digital agents and assistants interact with one another? What technological infrastructure is needed to make them talk to one another? Assume you feel unwell and suffer from an upset stomach, which personal AI assistant do you go first? You might go to your “own private AI” and ask “Why do I feel pain in my stomach”? Your own personal AI may refer you to your personal AI doctor. In this kind of scenario, it will be important to make sure that the initial inquiry made by you to your own personal AI is automatically transmitted to other agents. This will ensure that your AI doctor will already know your concern and will be able to continue the conversation. Such communication between AI-powered agents can only be possible in the human-centric data environment, where all the AI experts run on the user’s side. Sharing sensitive data outside of the user’s own personal data environment is not optimal. In fact, such communication between agents would be impossible in the old, enterprise-centric data ecosystem where data is locked in separate silos. Paths Forward As we stand on the entrance gates to the age of AI, the future seems quite exciting: how will our lives change when each of us will be able to tap into the potential of our Personal AI? The integration of Personal AI agents into our daily lives is not a question of if, but when and how. To bring this vision into reality, a shift in thinking is required. We need to embrace a human-centric data paradigm where our Private AI is operating on our side, on our own data, privately. At Prifina we are building an infrastructure to empower each individual with such “steamengines of the mind”; we want to empower developers to build Personal AI applications for people to augment each individual’s creative potential. Join us! On July 13, 2023, an event called “Augmenting Consumer Experiences in the Age of Data & AI” took place at the offices of New York Life Insurance Company's offices in San Francisco (kindly hosted by Boudjemaa Nait Kaci). Augmented UX with AI The event started with Jouko Ahvenainen from Prifina, who invited his fellow panelists to delve into their personal experiences, both triumphs and trials, relating to their interaction with the recently released AI and data-driven technologies. Heather Whitney from Morrison Foerster shared her excitement at the launch of ChatGPT. She underscored the versatile potential of generative AI, highlighting its role in revolutionizing customer experiences across a variety of sectors, notably content creation, gaming, as well as gene editing and drug development. Following up, AJ Tomas from Touchdown Ventures shed light on the latest unveiling from Humane Inc. — a secretive startup founded by former Apple executives — who have recently announced the forthcoming release of a cutting-edge gadget that generated quite a buzz in the tech world. Amit Sharma shared his vision: "We believe that generative AI has the potential to create innovative forms of content that go beyond the current video-based experiences on Instagram, YouTube, or Tiktok. These novel experiences will offer users the opportunity to engage with brands and services in a multimodal manner." Aaron Mollin (CEO, Ichijiku) offered a fascinating observation, arguing that most AI-fuelled experiences are curated from a “top-down” perspective. He recognized the transformative nature of tools such as ChatGPT, but called to realize that oftentimes he felt that such tools are detached from how we interact with material objects around us. Aaron shared an alternate viewpoint related to integrating AI-powered insights based on the data collected from ubiquitous sensor technology found in everyday physical objects, like wearable tech, IoT devices, and environmental sensors. He called this the "bottom-up" approach. One such example is a collaboration between his company, Ichijiku, and Prifina: their work has resulted in the creation of sensor-imbued luxury jackets (one of which he was wearing that night). This conversation immediately led to a conversation with audience members about the fact that we, individual consumers, all have cell phones, and we find it cumbersome to interact with hundreds of separate apps and services. From the consumer perspective, rather than multiplying points of interaction, it would be better to reduce our reliance of more and more devices and apps and make the UX more user-centric. Predicting the Future Jouko then asked panelists to share their thoughts on what changes consumers could expect in the next coming years. Amit did not hesitate to suggest that every aspect of consumer experience will change in the next few years. Some UX aspects will change faster than others, but gradually many industries will transform. E-commerce, online shopping, entertainment, and interactive experiences are the first ones to transform. AJ Tomas predicted that another area of fast-moving development is personal productivity. Aaron expressed his wonder about the impact of data on the way how individuals make decisions about their own lives. Lots of work appears to be needed to build personal recommendations and nudges for people. Jouko reiterated his favorite idea about predictions: although we do not have a crystal ball, we can actually make quite certain predictions about the future. Jouko noted that we can anticipate that certain things will happen (e.g., self-driving cars), but the challenge is to identify the timing: will happen in a year? Two years? Five years? Amit noted that the current developments in generative AI capture much attention of billions of people who are waiting to see what the actual breakthrough will actually look like: “And if you go back to the 1980s, people knew there would be something called ‘a computer.’ But nobody knew what a computer would look like … it wasn't clear that it would be a box on your table with something called a keyboard and a mouse… This is true for smartphones and, most recently, Apple VisionPro. We can’t even imagine what Apple VisionPro 14 will look like. And that uncertainty is what makes people excited.” Legal Issues To Be Resolved Heather shared insights based on her hands-on experience from working with generative AI technology companies; she provided an overview of some of the key legal issues that revolve around copyright, the legality of the use of data, and data privacy. These issues are currently unclear and are currently discussed among legal experts and AI entrepreneurs:

Heather and Jouko shared their views about the emotional narrative around these generative AI tools: many artists feel hurt and believe their works have been unlawfully used to train AI without their permission. The ethics of this debate raise controversial questions. On one hand, information in the public domain is supposed to be free. On the other hand, some stakeholders invoke strong arguments based on the ideas of exclusive ownership rights. Ichijiku: Combining Fashion, Cultural Expressions and AIAaron shared his unique perspective on using traditional kimono silk materials to create bespoke fashion items. Differently from the prevailing ideals in the luxury fashion industry, where consumers are made to feel that the luxury fashion items purchased just a few months ago are out of style and invited to purchase the next generation of items, Ichijiku aims to create life-long items that people could hold on to for their entire lives. Ichijiku embeds sensors in those fashion items and uses data to extend the lifetime quality of the garments. By implementing sensors and generating data, Ichijiku jacket owners can monitor explore to humidity, sunlight, and heat; the first, humidity, being the most kind of serious culprit for the degradation of silk. By using data and AI, Ichijiku aims to create a new type of experience that go even beyond the maintenance of one-of-its-kind silk. Additional information collected from other sensors, such as heart rate, could help people get insights into how they feel while wearing Ichijiku’s bespoke jackets. This is something that no one has ever been able to create. “For me, it's just all about, creating pieces that will stand the test of time. … Ichijiku aims to create these unbelievably beautiful, arguably one of the most intrinsically valuable items on the planet. And that I think, is what's going to really appeal to people. Technology will never be the selling point, although it is definitely appealing. We're using vintage silk fabrics, which ties closely to sustainability ideas. People understand just how beautiful the items they are buying. The use of data and technology helps us further the story.” -- Aaron Mollin Post-Event Networking

One of the remarkable features of the data and AI-related events currently happening in San Francisco is that people come to meet one another, learn about each other and what others are building. The same spirit could be felt at our event: attendees spent the remainder of the evening at our venue socializing, getting to know each other, and connecting on various social media platforms to stay in touch in the future. We at Prifina are excited to be at the heart of this historical moment; we feel inspired and motivated to continue building our Human-centric data platform for AI-powered apps and services. On June 8, 2023, Paul Jurcys, one of the co-founders of Prifina, attended a panel discussion entitled "Real Laws for Unreal Lands" hosted at the HQ of Treasury. Two other panelists were Max Sills (General Counsel, Midjourney) and Barath Chari (attorney, Wilson Sonsini), the event was moderated by John Manoochehri (CEO, Treasury). The panel discussion revolved around three main topics: the ownership of legal assets, legal liability for personal virtual agents, and future directions in setting forth the legal framework for new digital interactions. You can watch the entire discussion on YouTube... Or you can continue reading for some highlights of the discussion. Do real laws apply to unreal worlds? Barath emphasized the importance of recognizing that virtual worlds, despite being distinct from the physical realm, still have a significant impact on real-world individuals. He noted that there must be a way to establish responsibility and accountability within these digital environments. He further highlighted the need to navigate the gaps between current laws and emerging technologies, such as AI-generated content. For instance, the question arises of whether platforms creating virtual worlds can maintain their neutral platform status. “There's always somebody ultimately responsible for what happened. The practical challenge is determining how that responsibility gets allocated under the law. ” - Barath Chari Paul Jurcys from Prifina started by challenging the notion that real laws do not apply to unreal worlds. He emphasized that existing legal frameworks are indeed applicable to digital spaces. Although these laws may not be perfect or fully aligned with the unique aspects of virtual environments, they serve as a foundation for understanding the legal implications: “If you are building a platform, a game, or some kind of a virtual environment, the first legal thing you have is to draft the terms of use and privacy policy - these foundational documents are rooted in real-world laws.” - Paul Jurcys Max Sills shared some insights from the law and economics perspective. First, the concept of transaction costs suggests that laws should be designed to minimize these costs for private parties within the digital realm. Second, the concept of the "cheapest cost avoider" doctrine suggests that the responsibility for preventing harm in the real world and also in virtual worlds should lie with the party that can most efficiently address the issue. Finally, Max Sills explained that intellectual property (IP) laws are primarily designed to facilitate creativity rather than benefiting only those who possess preexisting property. The complex issue of owning digital assets The event moderator, John Manoochehri, wondered who owns virtual lands and what happens when the server goes down: is that land no longer available? Is the law clear on who owns what and who is liable for lost digital assets? Barath suggested that when we think about the concept of virtual land ownership, we need to identify what exactly constitutes virtual land. Is it a collection of digital bytes residing on a server within a specific environment? In reality, it boils down to the ability to exclude others from accessing or profiting from objects in the virtual space. This access right is usually achieved through contractual agreements. He suggested that one way to look at ownership issue could be through the lens of responsibilities: who is responsible for what? Paul Jurcys offered an example of user-generated data (e.g., data individuals generate through the use of wearable devices or mobile apps). Historically, data has been viewed as a public good, not owned by anyone and freely accessible: “Information wants to be free.” Defining data as an asset proves challenging due to its intangible nature and the absence of clear boundaries. However, if we think about the data collected and stored in one secure locker (e.g., user A’s personal data cloud), such data becomes unique and clearly defined and could meet the legal requirements to be considered as a “thing”. Paul emphasized, that as we generate more data in our daily lives, it becomes crucial to explore the concept of ownership and the necessary conditions to claim it. Max Sills noted that ownership of digital assets hinges on a stable legal and enforcement regime. In the absence of law, ownership becomes irrelevant as power dynamics prevail. To establish a meaningful concept of ownership for digital assets, competent and vested legal and enforcement systems are necessary to ensure stability between parties. “Look at a developing country where there is no stable government. It does not matter who owns a piece of property because if you come on someone's property, they'll kill you.” - Max Sills Additionally, Max addressed one of the most remarkable recent development: Japan Copyright Law modification allowing to train AI on any data. In a global environment, the competition among legal regimes becomes more and more apparent. As we move forward, the existence and choice of legal frameworks play a crucial role in defining ownership. The issue of ownership in the digital age involves complex considerations of excludability and rivalrousness. While private property traditionally relies on excluding others from its use, data poses challenges as it can be used simultaneously by multiple parties. The question arises: How can one retain ownership and prevent others from accessing their data? This issue remains unsolved in the data age, leading to resistance against traditional ownership premises. Japan's recent legal development allowing the use of copyrighted data for training datasets reflects the evolving nature of law in response to the value and accessibility of data. The panelists agreed that conventional ownership frameworks struggle to encompass the characteristics of digital assets, which often escape excludability criteria while being beyond rivalrousness. This is quite an exciting domain to follow because new approaches are evolving fast. Are new laws for avatars needed? The next topic that the panelists were asked to discuss revolved around avatars: as avatars are becoming our agents in various real-life and virtual environments, who is responsible for their behavior? Is it the person whom the avatar is representing? Or is it the provider of the virtual platform for avatars to interact with one another? How about third parties who embed AI-powered features into avatars? Paul Jurcys from Prifina noted that there are three categories of avatars that we can envision: (i) those that really act for the sole benefit of the individual herself (e.g., my own avatar that helps me better understand my sleep patterns); (ii) avatars that act as our agents (e.g., help my buy tickets to my favorite band’s concert); and (iii) avatars that interact with other agents in virtual words. Only the avatars in the latter category are likely to cause harm and lead to complex legal issues. “It is important to realize that avatars are not independent/autonomous entities; they are extensions of individuals' digital identities and act as human agents. The legal debate surrounding independent and autonomous avatars with legal personhood is mostly theoretical.” - Paul Jurcys Max Sills offered a very clear answer to this question of avatar liability: “I think everything will become corporate law. Corporations already have rights of free speech, they can commit crimes. … Establishing LLCs (limited liability corporations) for avatars will be the market-oriented way to organize liability.” Charting Legal Frameworks for the Digital Frontier

As we are witnessing rapidly evolving digital technologies, many intricate questions remain unanswered: who owns virtual representations of the real world? Is it possible to flex the legal muscle of current laws and regulations or are these laws outdated? Barath noted that copyright and intellectual property laws are just one of the possible tools to address the issue of digital ownership. Paul suggested that creators and developers would benefit immensely from clear rules that define what are the rules of the game. In this regard, recently adopted amendments to the Japanese Copyright AI provide a valuable guidepost and increase regulatory competition between Europe, Japan and US. “As we're moving forward, we need to think about new regulations that would not be reactive (based on things that happened), but forward-looking. … What kind of framework could we build based on what we anticipate from the new technological revolution?” - Paul Jurcys Max Sills made a great observation about financial incentives: For ownership to exist, there must be a financial system and a bustling market where transactions occur. “ Similarly to the “least cost avoider” approach which is applied for liability, rules defining the allocation of ownership should be based on the cost-benefit analysis: Who can utilize the assets in the most efficient way?” -- Paul Jurcys The panelists agreed that current legal frameworks that exist to help navigate in real laws will evolve and be adapted to how humans interact with one another in digital environments. Forward-looking, incentive-based, transaction-cost-reducing rules are desirable and needed. Bottom-up approaches and standards are very likely to emerge. One good example of such bottom-up regulation is Creative Commons licenses that help people manage their own copyrights with regard to works published in the current internet-based environment. The panelists agreed that we will see similar solutions emerging for more complex digital assets such as data, or three-dimensional representations of the real world. “From a legal perspective, we're gonna see a really chaotic period (which is happening now), and then … it will be very exciting.” - Max Sills |

Archives

May 2024

Categories

All

|

Sign up for updates* Prifina will not share it with any third party.

|

The User-Held Data CompanyPrifina is a venture-backed personal data technology company based in San Francisco. Prifina provides a personal data platform that empowers individuals to collect, combine and utilize their personal data to live happier and healthier lives. Consumer brands and developers can build apps and personal AI agents on top of user-held data.

© 2024 Prifina, Inc.

|